The Iranian currency rial has rebounded in recent days, rising to 120,000 to the U.S. dollar, on the open market midday Thursday, recuperating some of the losses it endured in recent months.

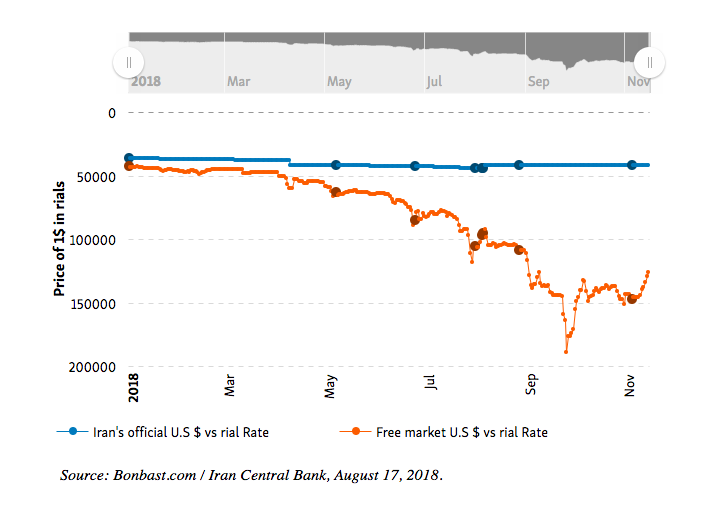

The rial, which was trading around 30,000 to the dollar at the beginning of 2018, began a steep decline in March and reached to as low as 180,000 before stabilizing around 150,000 in recent weeks.

The critical fall in the value of the rial, affecting the livelihood of most Iranians, was triggered by indications that U.S. President Donald Trump would pull out of the 2015 nuclear deal, which lifted earlier economic sanctions imposed on Iran.

In May the U.S. did pull out of the agreement and began reinstating sanctions, ultimately aimed at drastically reducing Iran’s oil exports and foreign investments.

A financial expert in Iran told the local Mehr news agency that as U.S. sanctions on oil exports kicked in on November 5, another shock was anticipated in the currency market, but “Central Bank’s interventions led to a reduction in the value of foreign currencies and gold”.

Although central bank interventions by infusing hard currencies into the market can be effective on the short term, it is not clear how long the policy can be maintained.

As the country’s oil exports have halved, the government’s ability to pump dollars into the market would be limited.