November 10, 2005

Tufts U. Will Use $100-Million Gift to Make Profitable 'Microloans' in Developing World Tufts U. Will Use $100-Million Gift to Make Profitable 'Microloans' in Developing World

By PAUL FAIN

Friday, November 4, 2005

Chronicle of Higher Education

Tufts University received a $100-million gift this week, the largest in its history, and plans to use the money in an unusual way: to make small loans throughout the developing world.

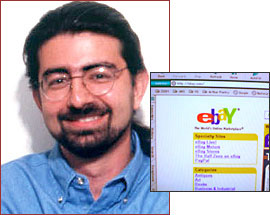

The strategy is designed not only to yield good returns, but also to spur economic growth in impoverished regions. The donation was made by Pierre Omidyar, a Tufts alumnus, and his wife, Pam. He is a co-founder and the CEO of eBay, the online auction house.

Lawrence S. Bacow, president of Tufts, said the university would "help to establish this investment sector" by proving that microloans -- which previously have been distributed mostly for philanthropic purposes -- can bring significant money to the university.

"It's our hope that, by demonstrating what the real returns are in this field, we'll encourage others," said Mr. Bacow, a lawyer and economist. The idea, he said, is "to do well by doing good."

Tufts received and immediately liquidated $100-million in shares of eBay stock this week.

The money will be managed as part of the endowment, with half of the income from the microloans going to the university to support financial aid, scholarships, and other programs. The other half of the income will be reinvested in the endowment, which was valued at $880-million as of June 30.

The microfinance model that Tufts plans to follow involves loans of about $600 over a three-month period, usually made to female heads of households. Tufts will charge interest on the loans.

Sally M. Dungan, Tufts's chief investment officer, said the university would make the loans in Central America, South America, Africa, India, and elsewhere in Asia.

She cited the hypothetical case of a mother who owned a single goat that helped to feed her family. With a small loan, she could buy a second goat and could then breed goats and sell the milk.

In areas of the developing world where people make $1 per day, it's not hard to "double your income," Ms. Dungan said.

Because of the short terms of the loans, Ms. Dungan said, Tufts would be able to lend each dollar four times per year, and also to borrow additional money on the balance several times per year, leveraging as much as $1-billion in loans on an annual basis from the $100-million.

Ms. Dungan said the university had already started to look at investments with the gift and hoped to lend the entire $100-million within three years.

According to a study by the Consultative Group to Assist the Poor, a Washington-based consortium which works to expand financial services in developing countries, the average microloan carries a 5.7-percent interest rate.

The university, which has hired one staff member to help manage the money, plans to work with established service providers that assist in microloans, such as Deutsche Bank and MicroVest, as well as with microfinance firms at the ground level in developing countries.

Eventually, Mr. Bacow said, Tufts students could help oversee the loans.

Ms. Dungan said she was not aware of another university that had "put this kind of focus" on microfinance.

The largest university endowments are well known for being at the cutting edge in asset allocation and growth. For example, by investing ahead of the curve in hedge funds and venture-capital funds, Yale University built a $15-billion endowment that has long been the envy of the investment industry.

Ms. Dungan said university endowments had also been at the forefront of investing in emerging and "frontier" markets, such as Iraq.

Tufts's stated approach to microfinance is avant-garde in that the bulk of investment in the sector has always been altruistic, with a secondary concern for returns. However, that will not be the case for Tufts's foray into microloans.

"Tufts is not in the business of philanthropy for others," said Mr. Bacow.

The gift was originally the idea of Mr. Omidyar, Tufts officials said. Mr. Omidyar, who graduated from Tufts in 1988 and began eBay in 1995, wants Tufts to imprint its successful approach to endowment management on the microfinance sector, Ms. Dungan said. As an early entrant into the field, she said, Tufts will focus on proving that the loans are good investments.

"We need to make this work," Ms. Dungan said, given that Tufts has an "opportunity to be in the forefront of a market."

Sent by Ali Khorsandian

*

*

Who's your Iranian of the day? Send

us photo

|