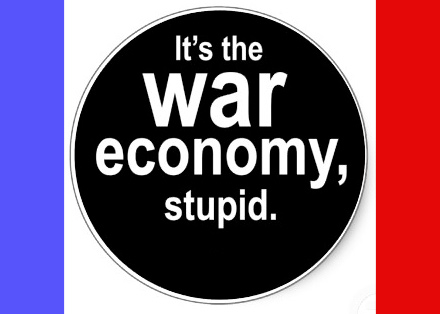

The weekly cost of U.S. war operations in Afghanistan is $2 billion, which makes the annual cost reach over $100 billion. So far, i.e., from mid February to April 22, the U.S. military and intelligence involvement in Libya has put a heavy burden of $1 Billion on the bent shoulders of the American working class.

These escapades and adventuresome undertakings are assumed at a time when the government on all levels: local, state and Federal are firing teachers, closing schools in working class neighborhoods, raising college tuition, threatening to raise the minimum retirement age to 70 years, cutting down on the allocation of funds to Medicare and Medicaid and wiping out a host of social services to the millions of working, unemployed and poverty-stricken population in American age-old cities and rural areas. In contrast, all this is taking place at a juncture when corporate rates of profit along with the rate of unemployment remain unprecedentedly high.

Time and again the leaders and spokesmen of the two ruling parties, Democrats and Republicans, blame each other for not creating jobs, while both wings of the ruling class know that the secret of U.S. high corporate profit rates lie in high rates of unemployment. More often than not, U.S. politicians blame China, and not the U.S. capitalist system with acutely unjust wealth and income distribution for the cause of unemployment and ills of the U.S. society. However, they ignore the fact that the average annual bonus that each employee of Goldman Sachs with 32000 workforce is over $500,000 or more.

According to the most recent survey about 70 percent of the Americans think that the country is going in a wrong direction and they are pessimistic about the future living lot of their children. Out of frustration and lack of class consciousness the majority may even vote in the next presidential election for such demagogues as Donald Trump, a real estate tycoon, who out of his “love for America” has never cast a ballot in any major election. This cuts deeply into the capitalist nature of American democracy, in which the ‘money bags’ buy their way into the U.S. Congress and the White House, an example that according to the U.S. corporate media proponents and bourgeois ideologues, other nations must follow.

But the dominant social system so far has been able to afford bearing the cost of hiring, developing and expanding a vast commercialized and quasi-private propaganda apparatus that 7-24 by every printing and electronic tools at its disposal (thanks to the power of tax collection) tries to ward off the facts and spread half-truths, barefaced lies and false consciousness. In order to divert the public attention as to the real causes of chronically-low economic growth rates, sporadic and insignificant scientific achievements, lower rates of capital accumulation and simultaneously high rates of unemployment, not only in the U.S. but also across the most developed capitalist economies of Western Europe, the media slaves point the fingers of blame at the emerging markets in China, India, Brazil or Russia for supposedly taking the jobs away from the American labor market.

Here it is necessary to cite the ratio of unionized labor to the entire U.S. labor force. According to the U.S. Department of Labor, Bureau of Labor Statistics on January 21, 2011, unionized labor in the U.S. was only 11.9%, down from 12.3 percent a year earlier, which showed a decline of 612,000 workers in the union ranks. Similar statistics for such countries as Belgium, Canada, Denmark, Finland, Italy, Norway and Sweden is 51.9%, 27.1%, 67.6%, 67.5%, 33.4%, 52.3% and 68.3%, respectively. In 1983, union membership in the U.S. was 20.1 percent with 17.7 million workers. Today, out of every 9 American workers only 1 has the support and the collective bargaining rights of a union!

But given the central motive force of the capitalist system which is to extract ever-higher rates of profit from any market regardless of its geographic whereabouts or the ethnicity of its labor force, for the U.S. policy-makers and mainstream media to blame other nations or countries for the lack of job creation in the U.S. is a sign of either deliberate misrepresentation of the main features of capital in the 21st Century or at best is a reflection of a narrowly nationalistic view of a social system that owes its very existence to higher rates of exploitation. In a few words: capital knows no motherland.

Furthermore, “As the U.S. economy has slowed and competition has remained fierce,” writes Karen Dolan of Morning Star Research Institute, “many firms have turned to emerging market economies for growth.” Additionally, Pat Dorsey searched the entire S&P market index through this lens in January 2010 and found that 40 percent of the revenues of the 500 largest U.S. corporations came from outside of the United States. To substantiate this fact, let us examine the stock holdings of three large cap mutual funds, namely Oakmark Select (OAKLX), Longleaf Partners (LLPFX) and Clipper (CFIMX). Among them, Oakmark had the highest U.S. weight by domicile, but the lowest exposure by revenue. Out of its 21 stock holdings, only three showed all of their sales in the U.S. The top position of this fund, Discovery Communications, earns 35 percent of its revenues abroad. Another holding in Oakmark Select Portfolio, Texas Instruments, is well known among U.S. consumers, but only draws 11 percent of its overall sales from the U.S. market.

Among many, two of the large holdings of Longleaf Partners – Dell, a major computer, monitor and printer manufacturer, and Yum Brands, the world’s largest restaurant along with its subsidiaries and retail outlets A&W, KFC, Long John Silver’s, Pizza Hut and Taco Bell – earned 47% and 60% of their revenues, respectively, outside the United States. Driven by the outstanding China and Emerging market performance, Yum Brands on April 18, 2011, announced the opening of 400 KFC franchise restaurants in Jakarta, Indonesia.

From the two above-mentioned cases, among others, three major conclusions could be drawn:

1) The purchase, use and consumption of the finished products of Dell and Yum Brands by the people in the developing countries, in this case, China and Indonesia, cannot be realized unless the products are grown, prepared and manufactured locally, employing the indigenous population;

2) This method almost eliminates the high cost of transportation both ways – export of raw materials and export of finished goods, which results in higher rates of profits for the corporation and it provides a market for the raw materials produced by the local mining companies and farmers;

3) The by-products of the concentration of labor and capital, vertically and horizontally, make the job of organizing the labor in powerful unions and socialist parties much easier.

In the sample of three mutual funds mentioned above, Clipper is a large blend fund. As of its most recent portfolio, the fund held 86% in the stocks of U.S.-domiciled companies, but the cut of revenue from foreign holdings remained as high as 65 percent. If the stock exchange indices are any indication of economic cycle and secular trends, then the above figures could be used to calculate the multiplicity of growth of the emerging economies in comparison to the mature capitalist economies. No wonder tens of thousands of western industrialists and financial directors daily visit such countries as China, India, Brazil, Russia, Indonesia, Turkey, Peru, Thailand and South Africa to mention just a few.

Let us be reminded that according to the official sources, in the first quarter of 2011, the U.S. economy annually adjusted had a growth rate of only 1.8 percent, while the average growth rates of the Gross Domestic Products (GDP) of China, India, Nigeria, the Philippines, Taiwan, Vietnam and Tanzania were 10.4 percent, 8.65%, 7.8%, 10.95%, 11%, 6.68%, and 6.77% respectively.

The U.S. is not the only country among developed economies that chronically suffers from insufficient rates of economic growth and high rates of unemployment. For example in 2010, the economic growth rates of the United Kingdom, Norway, France, Germany, Canada, Italy, Japan, Israel and Belgium were 0.42 percent, 0.29%, 0.37%, 1.00%, 0.80%, 0.325%, 0.625%, 1.265% and 0.525% respectively. The anemic growth rates of these countries are the prime causes of continuous high rates of unemployment, national debt and budget deficits. Among others, the organic compositions of capital, militarization of the economy, addiction to war, the highly inequitable wealth and income distribution which results in lack of sufficient and effective demand are the major causes of periodic recession and secular (long term) unemployment.

While the corporate media focuses on glorifying the killing of Osama bin Laden and creating near ‘hysteria’ about the Arab uprisings, the European Union and western developed economies are facing massive debt and crisis in the economic realm. On May 3rd, Portugal, now the third eruozone country to be bailed out of a sovereign debt crisis, reached a deal on a €78bn rescue package. Coupled with loans from the European Union (EU) and the International Monetary Fund (IMF), thus far the price tags on the bailouts come to $157 billion for Greece, $122 billion for Ireland, and most recently $116 for Portugal, the total of $473 Billion!

As we see, the developed capitalist countries of Europe, suffering from the unhealthy economic system of capitalism continuously are forced to be on “life support”, with more loans and bailouts before plunging into debt and social unrest. It is not only the Arab countries who are engulfed in citizen upheavals, demanding socio-economic changes. On May 6th, police confronted protesting doctors in Greece and striking civil servants in Portugal, as the unions and people protest the cut-backs in social services.

The day is not far off that the working class of America will demand righting the wrongs: stopping endless wars, halting the culture of glorifying violence and militarism, stopping the process of jailing millions of poor men and women across the country and finally ending the process of enriching the tiny layer of billionaires while the majority of the society suffers higher costs and chronic unemployment.

AUTHOR

Ardeshir Ommani is co-founder and president of the American Iranian Friendship Committee (AIFC) www.iranaifc.com, he writes articles of analysis on Iran -U.S. relations, the U.S. economy and has translated articles and books from English into Farsi, the Persian language. Contact: Ardeshiromm@optonline.net