As US stocks seesaw with every conflicting trade-war related headline, investors are fixating on tomorrow night’s dinner meeting between President Trump and President Xi with laser-like focus. But the Trump-Xi summit isn’t the only meeting that could have broad repercussions for global markets, and though it has received much less attention in the press, the planned meetings between Russian President Vladimir Putin and Saudi Crown Prince Mohammad bin Salman (along with the Russian and Saudi energy ministers) could dictate the course of global oil prices for the foreseeable future.

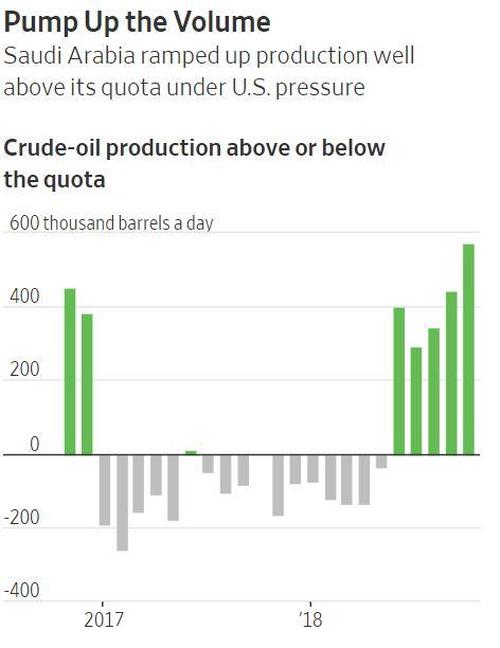

Looming over the Saudi-Russia talks are suspicions that Saudi Arabia has been accelerating production of oil beyond the cuts adopted by OPEC+ in November 2016 to placate President Trump – a conspiracy “theory” first highlighted by Zero Hedge weeks ago, which has finally won acknowledgment in the pages of the Wall Street Journal and other mainstream press.

But while Saudi and Russia are equipped to weather lower-for-longer oil prices (Putin has said he’s “absolutely fine” with oil at $60 a barrel), especially if it means they don’t cede market share to the booming US shale industry, other OPEC members have been frustrated by the bilateral agreement to raise output through the end of the year.

And during a meeting of OPEC producers and their non-member allies next week, it appears these other members might present their de facto leader with an ultimatum: Cut production – now – or risk a mutiny. At least that’s what a report published in the Wall Street JournalFriday morning would suggest.

Two days after Saudi Energy Minister Khalid al-Falih insisted that Saudi Arabia wouldn’t cut production if it meant going it alone, the WSJ reported that Iran and other oil producers are preparing to confront Saudi Arabia next week and demand that it bear the brunt of oil production cuts. Since the Saudis have ramped up production by 1 million barrels a day since the summer, OPEC reasons that they should bear the brunt of the expected 1.4 million barrels a day that they’re hoping to trim from the cartel’s collective production. “The Saudis made this mess – they need to clean it up,” one anonymous OPEC official reportedly told WSJ.

Even as the Saudis and Russia helped boost crude prices by raising the possibility of a tandem production cut, other OPEC members worry that the Kingdom won’t be able to undo the pain of its production ramp so easily. Given that it’s now pumping more than 11 million barrels a day, analysts are skeptical about whether a 500,000 bbl/day cut would make a difference.

But questions of supply and demand, while important, distract from a bigger issue: That other OPEC members are deeply uncomfortable with the perceived US influence over the cartel’s de facto leader. Cartel members described Saudi Arabia’s perceived deference to the US as “problematic.”

OPEC officials say the Saudis’ decision to keep pumping at full tilt is the result of pressure from the U.S., which has threatened to retaliate over the killing of dissident Jamal Khashoggi by Saudi operatives.

While President Trump said this week he wanted to keep a strategic alliance with the kingdom, the U.S. government and Congress have been looking at possible sanctions against Saudi Arabia, including legislation that would make membership of OPEC an antitrust violation.

An African OPEC delegate said the Saudis’ role as the cartel’s kingpin is problematic “because they follow instructions from the U.S.” An Iranian oil official said “whether they cut or not, the decision should be made in OPEC, not in the White House.”

Over the past few years, OPEC members have set aside their individual differences and worked with outsiders like Russia to rescue crude prices from their 2014-2015 collapse. But with this accomplishment fading from view, the notion that resentments about perceived US influence could lead to the dissolution of the cartel are ironic. After all, the breakup of OPEC would only cede more influence to the US.