به زبان فارسی

PICTORY

LATEST MUSIC

SEARCH

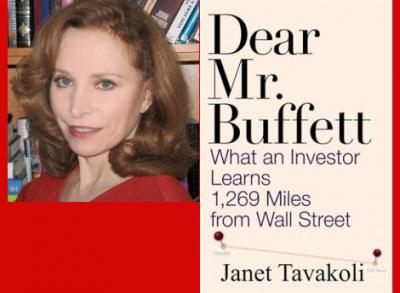

Janet Tavakoli

Tavakoli takes you into the world of Warren Buffett by way of the recent mortgage meltdown. In correspondence and discussion with him over 2 years, they both saw the writing on the wall, made clear by the implosion of Bear Stearns. Tavakoli, in clear and engaging prose, explains how the credit mess happened beginning with the mortgage lending Ponzi schemes funded by investment banks, the Fed bailout and its impact on the dollar. Through her narrative, we hear from Warren Buffett and learn how his enduring principles caused him to see the mess that was coming well in advance and kept him and his investors well out of the way. >>> tavakolistructuredfinance.com

"Good Bank vs. Bad Bank" analysis:

| Recently by PedramMoallemian | Comments | Date |

|---|---|---|

| Just a t-shirt | 8 | Jan 29, 2009 |

| Poll, Schmoll | - | Sep 29, 2008 |

| McCain 1 - Obama 0 | 19 | Sep 26, 2008 |

RECENT COMMENTS

IRANIANS OF THE DAY

| Person | About | Day |

|---|---|---|

| نسرین ستوده: زندانی روز | Dec 04 | |

| Saeed Malekpour: Prisoner of the day | Lawyer says death sentence suspended | Dec 03 |

| Majid Tavakoli: Prisoner of the day | Iterview with mother | Dec 02 |

| احسان نراقی: جامعه شناس و نویسنده ۱۳۰۵-۱۳۹۱ | Dec 02 | |

| Nasrin Sotoudeh: Prisoner of the day | 46 days on hunger strike | Dec 01 |

| Nasrin Sotoudeh: Graffiti | In Barcelona | Nov 30 |

| گوهر عشقی: مادر ستار بهشتی | Nov 30 | |

| Abdollah Momeni: Prisoner of the day | Activist denied leave and family visits for 1.5 years | Nov 30 |

| محمد کلالی: یکی از حمله کنندگان به سفارت ایران در برلین | Nov 29 | |

| Habibollah Golparipour: Prisoner of the day | Kurdish Activist on Death Row | Nov 28 |

Dear Mr. Buffett

by Vince A (not verified) on Mon May 18, 2009 01:15 PM PDTAs a novice in the financial business, It would have been helpful if a short glossary of terms were added to her book. I found it very interesting but forgot some of the meanings of abbreviations...

Thanks

Wild Wild West

by Ajam (not verified) on Tue Feb 24, 2009 09:02 AM PSTThis was an unbridled capitalism the Wild Wild West style that was bound to nose dive! Even in a last October interview (five month ago), when asked about the market troubles, GWB said, "it's just market trying to adjust itself!" Back in 1997, Bre-X, a Canadian co. robbed investors and the market out of billions by overstating and manipulating its asset reports. As a result, the government of Canada halted trading until the securities commission carried out investigations and indicted those responsible for the scheme. Consequently, Canada has implemented a tight "checks and balance" system to keep the market and its banking system on a tight leash ever since.

However, such measures have been dismissed by the majority of Americans as "socialism." Without a system of oversight, greed would take over conscience in marketplace and result in what we see in the U.S.! Now they have to resort to even more drastic socialist measures such as nationalizing (at least temporarily) the main financial institutes (as Sweden did its banks) if they want to separate the toxic assets from the good ones (as she suggests in above interview).

All in all, there is no "great capitalist" system anymore. The leading economies of the future will be the so-called mixed economies. The sooner Americans realize that the better a chance they have to be a contender in the future world order. These are the signs of the unbridled capitalism on its death-bed!

I agree with Benyamin.

by Anonymous.... (not verified) on Mon Feb 23, 2009 08:22 PM PSTWhy aren't you guys puting me on as the Iranian of the day? I am a real Iranian and what I do is far better than talk out of both sides of my mouth like Wall street analysts do?

These analysts basically go where the wind blows, and these pirates stole and lied until they pushed the great capitalist system of this nation into a near total collapse, which could happen in the weeks and months ahead.

To Janet Tavakoli

by Benyamin on Mon Feb 23, 2009 05:55 PM PSTThe problem is much BIGGER, DEEPER and wide spread than just few banks, I believe the USAs economy is not good to serve and provide for 350 millions people. It is good for much less, I would say at the most 250 millions. So what happened is not JUST few bankers got greedy but a front to finance the Empire of USA! I say FRONT because they lured all other countries to buy over rated American assets.

That is how the old USA could in fact provide for such a big population not much productions or real value assets. So the worse yet to come, the worse has not yet hit the fan in my opinion. I HOPE I AM WRONG.