به زبان فارسی

PICTORY

LATEST MUSIC

SEARCH

TRUE or FALSE: Will the US dollar collapse?

by Iqbal Latif

07-Sep-2011

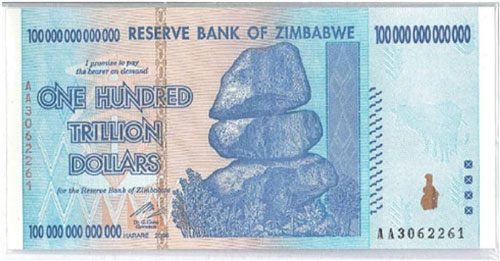

I was asked in a lecture in Paris recently if US $ faces the same dilemma as Zimbabwe,Hungary or Germany? Zimbabwe – 100 Trillion Dollar, 2006 Hungary – 100 Quintillion Pengo, 1946 or Germany – 1 billion mark, 1923. Of course the question was loaded and triggered by Gold bugs and a recent report from MG Bullion Bars.

MG Bullion Bars has published a poster featuring pictures of numerous currencies that have gone bust.The question they pose is will the US dollar collapse. According to them, debts and deficits are what lead to the downfall of currencies. US total debt now exceeds GDP by roughly 400%.

At independence in 1980, the Zimbabwe dollar (ZWD) was worth about US$ 1.25. By 2004, Zimbabwe started to experience chronic inflation. It’s Inflation reached 624% in 2004, then fell back to low triple digits before surging to a new high of 1,730% in 2006. By June 2007, inflation in Zimbabwe had risen to 11,000% year-to-year from an earlier estimate of 9,000%. Reserve Bank of Zimbabwe took the easy way by issuing bank notes or “bearer cheques” with face value from ZWN 100 million to 100 billion. Meanwhile, inflation officially surged to 2,200,000% with some analysts estimating figures surpassing 9,000,000% .

As of 22 July 2008 the value of the ZWN fell to approximately 688 billion per 1 USD. On 19 August 2008, official figures announced for June estimated the inflation over 11,250,000% and by July, the inflation skyrocket to 231,000,000% (prices doubling every 17.3 days). Eventually it was calculated that Zimbabwe’s monthly inflation peak at the rate of 79.6 billion percent or 98% daily rate – prices were doubling every 24.7 hours.

Zimbabwe’s economy failed to surpass Hungary’s 1946 inflation world record. Birds of the same feather flock together, huh? This higher 100 trillion denomination note is representative f that hyper inflation.

After the end of World War II, Hungary’s hyper-inflation was so serious that it was peaking at 4.19 × 1016 percent per month (prices doubled every 15 hours) – the most severe known incident of inflation. In order to keep up with the inflation rate, the government issued the 100 Million B-Pengo note in 1946. A B-Pengo is equal to one billion pengo, but in European terms a billion is equal to one-thousand milliard, or one trillion in American terms. Therefore, the 100 Million B-Pengo is essentially equal to 100,000,000,000,000,000,000 (100 quintillion) Pengo. It was worth about U.S. $0.20 in 1946. Eventually, 29 zeroes were dropped when the Forint was adopted in mid-1946.

According to MG Bullion Bars'Once a country’s payments on debt exceed 30% of tax revenue, the currency is “done for.” The US will hit that figure by October 2011. Hyperinflation is caused by government budget deficits. This year’s US budget deficit will end up being $1.5 trillion, an amount never before seen in history.'

Their guru Jeff Clark writes in an article titled 'A Thousand Pictures is Worth One Word,' that "the possibility of the greenback crashing grows daily, and there will be painful consequences for Americans’ standard of living."

According to him, 'Since the Fed’s creation in 1913, the US dollar has lost 95% of its purchasing power. Government leaders don’t know how to, or don’t want to, keep the currency strong.'

Dr. Steve has given a very adequate reply, but I would like to add my two cents' worth. Let me look at the facts to test whether the 'Gold Guru' statement is correct or incorrect, i.e.,' Since the Federal Reserve’s creation in 1913, the dollar has lost 95% of its purchasing power. '

US Population in 1915 was 101m; now in 2011 the US population is 313 m. US Federal spending in 1915 was $0.75 billion in 2011 it is 3.2 trillion. DOW Avg stood at 99.15 in 2011 Dow Avg is around 10.000-11,000. GDP 2010 (purchasing power parity): $14.66 trillion.

Avg. Income in 1915 was $1,076 in 2011 it stands at $63,000.

New Home (Median Price) in 1915 was $4,800; in 2011 In the Northeast, the median price dropped to $245,600 from $261,100 in June, and it fell 6.8 percent over July 2010. The median price in the Midwest slipped down to $146,300 from $147,700, and fell 2.9 percent from the previous year. In the South, the price fell to $152,600 from $159,100 in June, and dropped 2.2 percent in a year-over-year comparison. The median price in the West slumped to $208,300 in July from $240,400 and fell 7.1 percent from the year before.

You would need three times annual average income today to purchase a New Home (Median Price) whereas in 1915 it was 4.5 times the average annual income to purchase a New Home (Median Price). Actually the dollar has remained stable or has in fact higher purchasing power as far as New Home (Median Price) go with far better amenities than a New Home (Median Price) of 1915.

(//www.realestateabc.com/outlook/overall.htm )

Let's now look at the New Car (Avg. Cost) in 1915 was $500.00. In 1915 car was a luxury restricted to the narrow band of the top ten percent of the society. In 2011 not only 90% own cars, USA have 254.4 million registered passenger vehicles in the United States. In the year 2009, 5,456,246 passenger cars were sold in the United States. According to the National Automobile Dealers Association, as of 2010 the average cost of a new car in the United States is somewhere around $28,400.

The buying power to purchase a car has gained in US$ terms actually, not declined. In 1915 it would be around 50% of annual income, in 2011 it is 44.4 percent to purchase a far better, powerful and an economical car. The amenities, luxury, ability to travel long distance and quality of the two cars cannot even be compared.

(The Average Cost for a New Car | eHow.com //www.ehow.com/facts_5977729_average-cost-new... )

Now the most important: the Gas (gallon) prices in 1915 were 8¢ a gallon, in 2011 it is 5.905$ a gallon, if you calculate based on annual outlay on Gas for an average person based on 2.56 gallon/US resident/day consumption, even with hockey like spike in Gas prices since 2005, the purchasing power of US$ has only slightly eroded.

In 1915 at 8 cents a gallon with the same consumption patterns of today (this is something that I think is rational to assume- if fuel efficiencies of the modern cars are taken to consideration, all bets are off; to travel the same distances as today in a 1915 car would be thrice as inefficient and are hence far more expensive), an average driver would have spent 6.94% of its annual income on Gas, today it is 8.75% of its average annual income.

As life standards improved so did energy consumption patterns. It is energy availability and its consumption that defines the quality of life to a large extent. Stability of purchasing power of US $ was achieved by maintaining higher and better living standards.

The Economy guru I follow religiously Dr Steve has this to add:

'We should 'trust Fed to do a BETTER job of preventing both dollar-inflation and dollar-deflation than would (a) politicians; or (b) South African or Russian gold miners.“Fiat dollars” supplied by its own central bank.

That gives us monopoly control over the supply of those dollars -- control we do not have over the supply of gold, diamonds, or seashells. No other nation can produce U.S. Fiat dollars; many other nations can produce gold, diamonds, or seashells. How well we manage that monopoly is completely up to us.'

I've been hearing the dire warnings about hyperinflation for at least forty years, including the most recent two years since the Fed has been "printing" all of that fiat money; money which, according to gold-peddlers like Glenn Beck, was supposed to trigger the Weimar scenario. As usual, "Weimar USA" didn't happen -- yet; also as usual, it's supposedly "just around the corner."

The gold bugs seem to be ignoring the equation of exchange, MV=PT, which tells us that there is no price inflation (P) when an increased money supply (M) is offset by falling money velocity (V), which is what happens to money velocity when newly-printed money just sits there in excess reserves. Further, the equation also tells us that DEFLATION can be the dangerous condition EVEN IF the money supply increases.

[In the real world, it is IMPOSSIBLE to measure the "money supply," as the Fed has learned since Volcker's chairmanship; that's why the Fed now targets the interest rate instead of the "money supply." But the equation of exchange is an instructive exercise, in thought in any case.]

In short, the evidence tells me that the Fed is on the right track, and that the hyperinflation peddlers haven't looked closely enough at either the evidence or the equation of exchange.

| Recently by Iqbal Latif | Comments | Date |

|---|---|---|

| Ashraful Makhlookaat!!! Gods imperfect 'Prime Creation.' | 3 | Dec 04, 2012 |

| Defining 'infinity' with our 'finite minds.' We live in-between two infinities! | 14 | Dec 03, 2012 |

| Stop this strange 'scriptural Puritanism' of democratic Israel. | 8 | Dec 01, 2012 |

RECENT COMMENTS

IRANIANS OF THE DAY

| Person | About | Day |

|---|---|---|

| نسرین ستوده: زندانی روز | Dec 04 | |

| Saeed Malekpour: Prisoner of the day | Lawyer says death sentence suspended | Dec 03 |

| Majid Tavakoli: Prisoner of the day | Iterview with mother | Dec 02 |

| احسان نراقی: جامعه شناس و نویسنده ۱۳۰۵-۱۳۹۱ | Dec 02 | |

| Nasrin Sotoudeh: Prisoner of the day | 46 days on hunger strike | Dec 01 |

| Nasrin Sotoudeh: Graffiti | In Barcelona | Nov 30 |

| گوهر عشقی: مادر ستار بهشتی | Nov 30 | |

| Abdollah Momeni: Prisoner of the day | Activist denied leave and family visits for 1.5 years | Nov 30 |

| محمد کلالی: یکی از حمله کنندگان به سفارت ایران در برلین | Nov 29 | |

| Habibollah Golparipour: Prisoner of the day | Kurdish Activist on Death Row | Nov 28 |

Purposelessness of Gold

by Iqbal Latif on Thu Sep 08, 2011 04:12 AM PDT''Caliph was locked in his treasury and was brought gold rather than food. When the Caliph protested that he could not eat gold, Hulagu asked why he hadn't spent his treasury on providing for his army and defense to which the Caliph cried "That was the will of God". In response Hulagu replied, "What will happen to you is the will of God, also," leaving him among the treasure to starve. ''